Schedule a Call Back

search Result

Will revised MSME classification solve their funding puzzle?

Only 14 per cent of credit needs of Micro, Small and Medium Enterprises (MSMEs) - the backbone of India's economy - are met through formal channels. The revised MSME classification may mark a pivotal shift in how India supports and enables its small business ecosystem, says Rakesh RaoRead more

MSMEs: The Fight for Financing

As India seeks to become the world’s third-largest economy by 2027, measures are afoot to resolve the funding-related challenges routinely faced by the country’s humongous MSME segment to truly transform it into a strong industrial economy backbone, says Manish Pant.Read more

Montra Electric, Ecofy to revolutionise EV Financing for vehicles in India

This strategic collaboration will make it easy for customers to own a Montra Electric Super Auto while expanding Ecofy's Commitment to Climate Finance and Accelerate the pan-India Adoption of Electric Mobility.Read more

Bajaj Finance plans to venture into SME, 4-wheelers, tractor financing

During Q1FY24, Bajaj Finance recorded a significant increase, with 79.94 million new loans, representing a 34% growth compared to the previous year.Read more

Greening Enterprise Eco system, SIDBIs dedicates Mission 50K-EV4ECO

Small Industries Development Bank of India (SIDBI) with the aim to strengthen the EV ecosystem, launched Mission 50K-EV4ECO which will unlock the market by providing better financing terms for electric two- wheeler, three-wheeler, and four-wheeler (2W, 3W and 4W) vehicles purchase. Read more

RBI extends support for small businesses with Resolution Framework 2.0

Small businesses engaged in retail and wholesale trade other than those classified as micro, small and medium enterprises (MSMEs) will also be eligible to avail the benefit. The central bank also allowed MSMEs with loans of up to Rs 25 for restructuring businesses crore in a separate notification.Read more

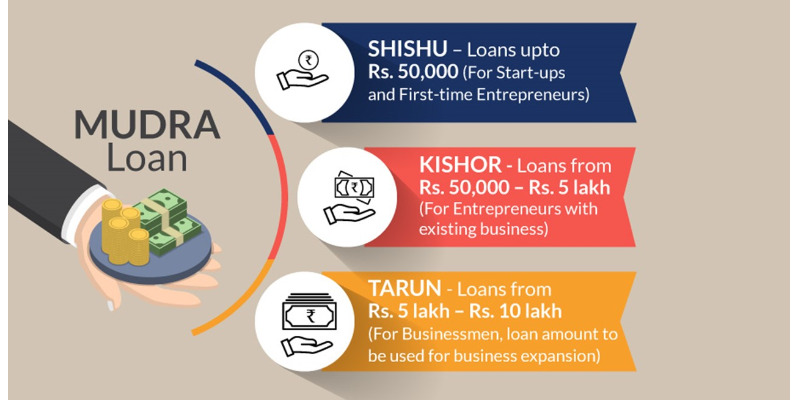

MUDRA Yojana helps generate 1.12 cr additional employment between 2015 to 2018

The loans are given for income generating activities in manufacturing, trading and services sectors and for activities allied to agriculture.Read more

Extending income tax exemption to MSMEs to be highly beneficial

The Government should introduce a long-term solution in the 2019 Budget that can save the credit-starved MSMEs from their dire state.Read more

Honouring excellence in SME sector

Over the last couple of years, while discussions centered on large corporate loans going bad, stress in the small and medium enterprises (SMEs) segment has witnessed perceptible increase. SMEs are also struggling to access funds due to the prevailing tight liquidity position in the domestic market.Read more

Government's credit guarantee to reach Rs 500 billion under CGTMSE for FY19

With a view to allay the trade finance woes of micro, small and medium enterprises (MSMEs), the Union Government has planned to more than double the credit guarantee up to Rs 500 billion for 2018-19 under the Credit Guarantee Fund Trust For Micro and Small Enterprises (CGTMSE) schemeRead more